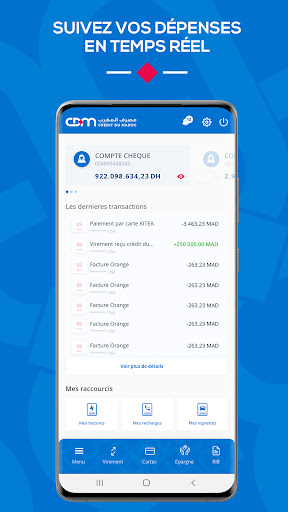

myCDM, the mobile application of Crédit du Maroc, diversifies its functionalities and services to meet your financial needs remotely

and offer you a more complete experience.

Explore the new features:

Online account opening:

- Open an account at Crédit du Maroc in a few simple steps, directly from your myCDM application and access a range of attractive packs.

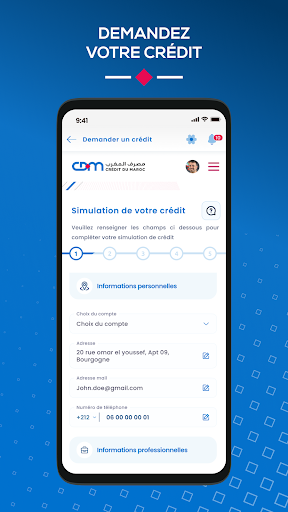

Online consumer credit application

- Submit your consumer credit application in just 15 minutes, independently from your myCDM application, and receive a response within 1 hour.

Offers and promotions

- Explore current offers from the home screen of your myCDM application and don't miss any promotions.

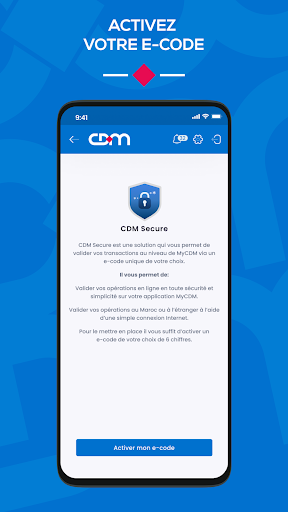

CDM Secure:

- Activate the CDM Secure service to validate your transactions easily with a 6-digit e-code that you choose. Your e-code can be modified or reset at any time from your myCDM application.

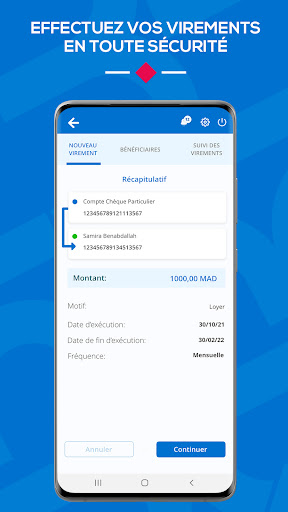

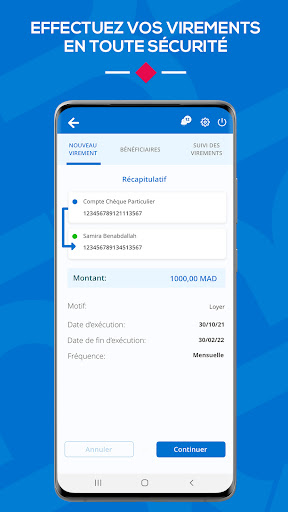

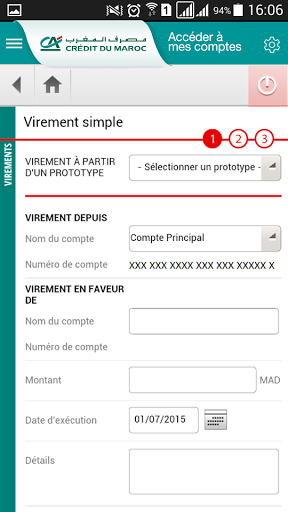

Transfers:

- Make instant transfers from your myCDM application to accounts opened with other banks in Morocco which will be credited in 20 seconds. Choose from standard, scheduled or permanent transfers.

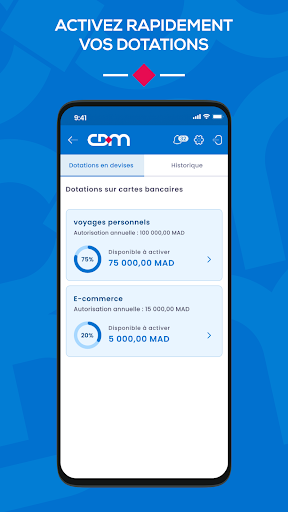

Foreign currency allocations:

- Instantly activate your personal travel allocation on your international bank card for your trips abroad as well as your e-commerce allocation on your E-Buy card for your online purchases, from your application myCDM.

Transactional offer:

- Instantly activate transactional features in your myCDM application via the “Settings” section to be able to make transfers, pay bills and much more.

- Activate the validation of your transactions via biometrics (fingerprint or face ID) from the "parameters", "CDM Secure" section.

Personal information:

- Instantly modify your telephone number or your contractual email from the “Settings” section of

your myCDM application.

Cash transfer:

- Make funds instantly available to beneficiaries (Crédit du Maroc customers and non-customers) from your myCDM application to be collected at an ATM or Crédit du Maroc agency.

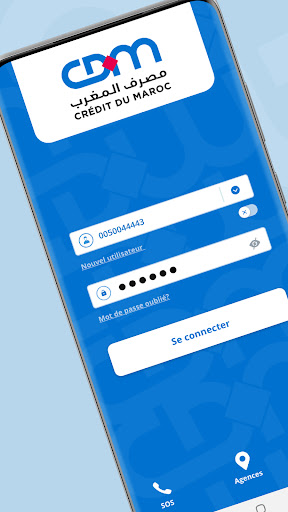

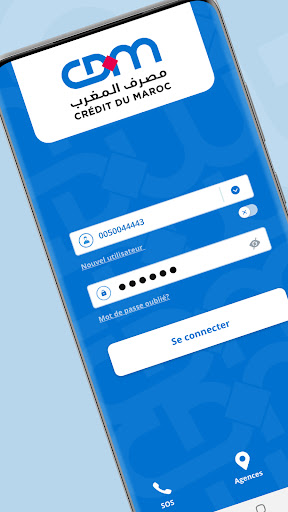

Connection with a trusted device and temporary telephone:

- Enter a unique secret code sent by your bank for the first connection to your myCDM session. You can register or remove one or more phones as a trusted device for added security.

Weekly transactional ceiling:

- Manage your weekly transactional ceiling, upwards and downwards, according to your financial needs from your myCDM application.

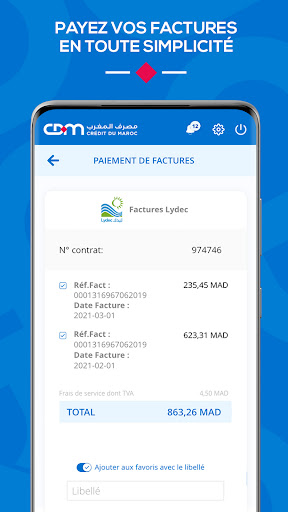

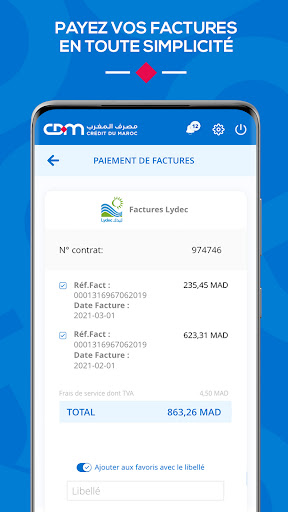

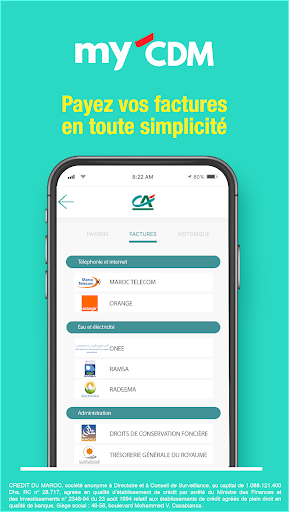

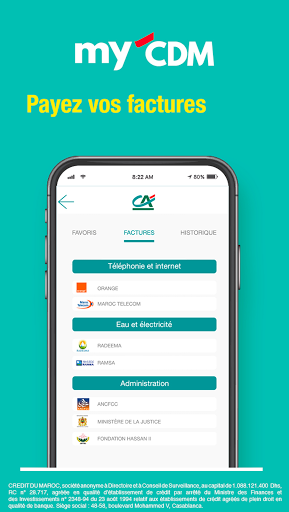

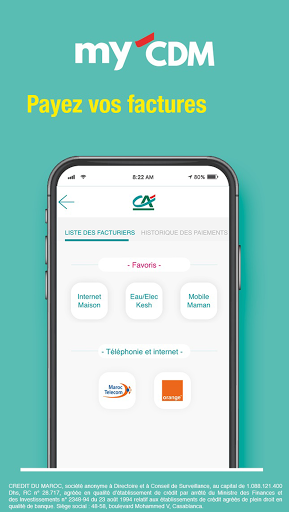

Bill payments and recharges:

- Pay your invoices and carry out recharges with several national billers from your myCDM application.

Bill payments and recharges:

- Pay your invoices and carry out recharges with several national billers from your myCDM application.

Cards:

- View the details of bank card transactions, configure your withdrawal and payment limits, lock/unlock your card and cancel your card in the event of loss or theft, from your myCDM application.

Setting instant notifications/alerts:

- Choose the instant notification channel, push and/or email. And this, by category of operations.

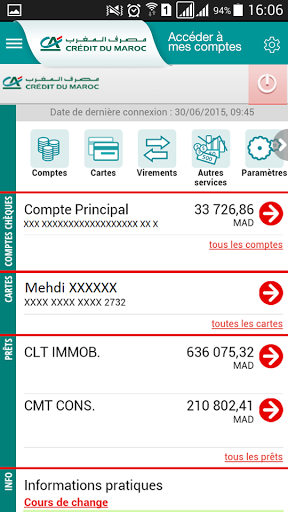

Savings and credits:

- Access a summary of your savings invested and credits granted.

- Download your amortization table for free for real-time monitoring of your credits without going to an agency.

For any request for information or assistance, please send us an email at: mycdm@cdm.ma or contact our

Customer Relations Center at 3232, Monday to Saturday from 8 a.m. to 8 p.m.

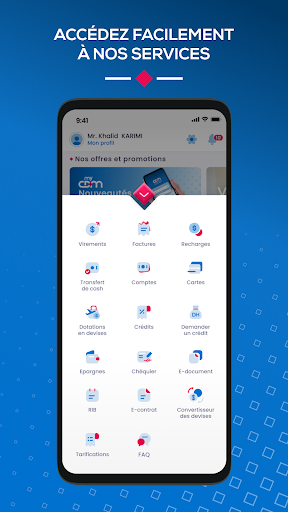

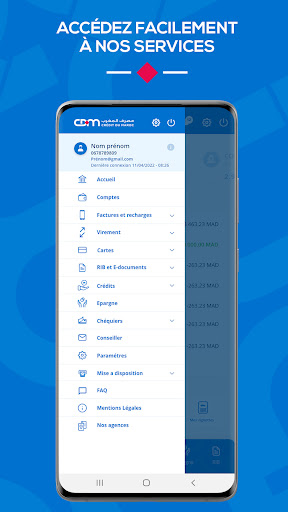

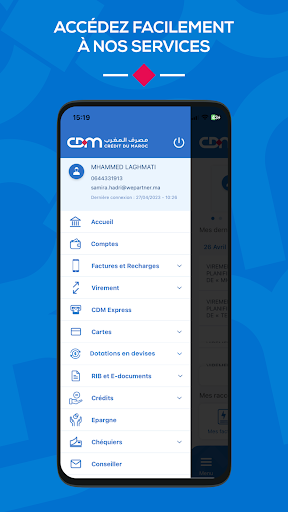

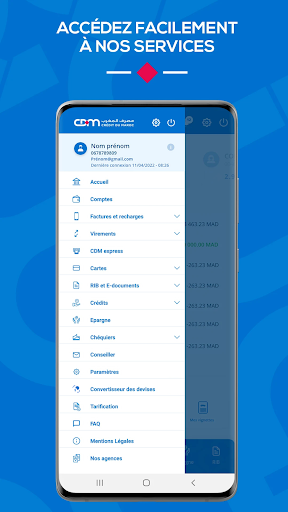

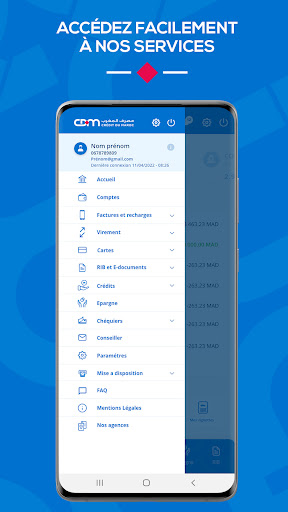

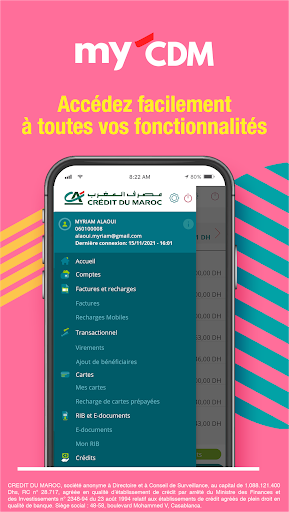

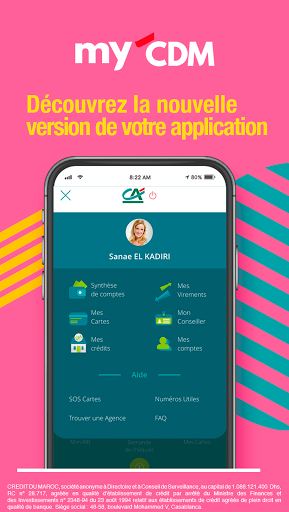

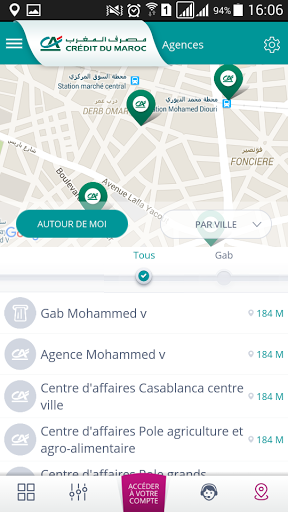

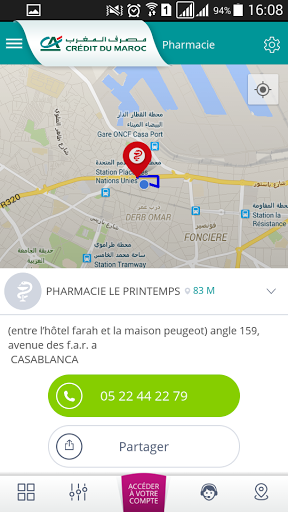

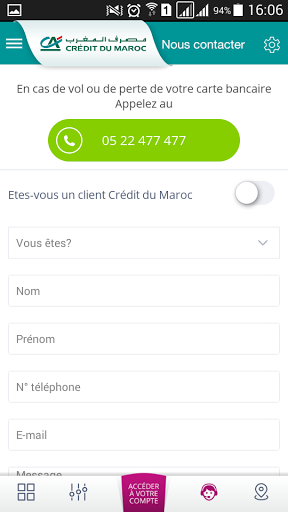

SCREENSHOTS

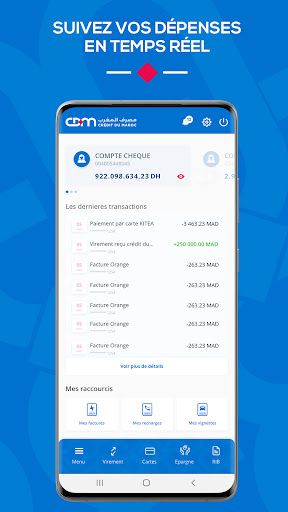

Discover the latest version of myCDM, with a completely redesigned design, for an even more fluid and intuitive experience, and new features:

• Activation of CDM Secure for enhanced security of operations using an e-code or biometrics.

• Reexecution of an old transfer.

• Consultation of the amortization table.

Discover the latest version of myCDM, with a completely redesigned design, for an even more fluid and intuitive experience, and new features:

• Activation of CDM Secure for enhanced security of operations using an e-code or biometrics.

• Reexecution of an old transfer.

• Consultation of the amortization table.

Discover the latest version of myCDM, with a completely redesigned design, for an even more fluid and intuitive experience, and new features:

• Activation of CDM Secure for enhanced security of operations using an e-code or biometrics.

• Reexecution of an old transfer.

• Consultation of the amortization table.

Discover the latest version of myCDM with a completely redesigned design for an even more fluid and intuitive experience with new features:

• Online account opening

• Online consumer credit application

• Offers and promotions

Discover the new services on the MyCDM App:

• Online account opening

• Online consumer credit application

• Offers and promotions

Please evaluate the MyCDM App! Your feedback helps us improve, to serve you better.

Discover the new service on the MyCDM App:

CDM Secure: the transaction validation service on MyCDM, which allows a simplified user experience, while offering enhanced security thanks to the use of an e-code 6 digits defined by the customer.

Please evaluate the MyCDM App! Your feedback helps us improve, to serve you better.

Discover new services on the MyCDM App:

- Instant transfer. -Activation

of foreign currency allocations: personal travel and e-commerce. -Activation

of the transactional offer to carry out all transfer operations, bill payment, provision...

-Modification of the telephone number and contractual email.

Please evaluate the MyCDM App! Your feedback helps us improve, to serve you better.

Discover new services on the MyCDM App: -Instant

transfer . -Activation

of currency endowments: personal travel and e-commerce. -Activation

of the transactional offer to carry out all transfer operations, payment of invoices, provision...

-Modification of the contractual telephone number and e-mail.

Please evaluate the MyCDM App! Your feedback helps us improve to serve you better.

Discover the instant transfer service on your MyCDM App. We

wish you a great experience!

Please rate your MyCDM App! Your feedback helps us improve to serve you better.

• Crédit du Maroc's new visual identity

• Management of your weekly transactional ceiling

• Instant notifications/alerts on your trusted devices

• Multi-user access

• Enrichment of the descriptions of movements of your accounts

• Enrichment of the list of billers.

Good update!

The display of unpaid credit.

Good update!

Don't forget to rate us! Your positive feedback always makes us happy.

We fixed some bugs and optimized the general performance of the application. Good update.

- New billers including sticker payment

- e-Documents

- Change and personalization of password

- Informative and advertising

banners - Connection via Face ID (valid for iPhones only)

- New billers including sticker payment

- e-Documents

- Password modification and personalization

- Informative and advertising

banners - Connection via Face ID (valid for iPhones only)

New bill payment route.

For your convenience, your application has evolved!

With this new update:

Pay your bills and phone recharges on your App (this service will be enriched over time with other billers).

And many other features ... to discover

Biometric authentication via fingerprint.

History of transfers.

Balance histogram over 30 rolling days.

Improved application performance.

Biometric authentication via fingerprint.

History of transfers.

Balance histogram over 30 rolling days.

Improved application performance.

New:

A new, more intuitive design

A lighter view of your accounts

Your ultra-simplified transfers

* excluding interbank transfer fees

Functional improvements

LG Stylo 3 Plus

LG Stylo 3 Plus